“If your medical records were accessed during the [Company Name] breach, you could get a payment from a class action settlement.”

Seeing a line like this in big, bold letters at the top of a card in your mailbox or a PDF attachment in your inbox can feel like a jump scare.

But don’t panic—at least not about the message itself. What you received is a class action settlement notice. What is a class action settlement notice?

This guide lays it all out in plain English. You’ll also learn why you got the notice, how to tell it’s real, what you’re supposed to do next, and, of course, how to make sure you don’t miss the payout you’re entitled to.

Key takeaways

- A settlement notice usually means you may be owed money

It’s an official message explaining that a lawsuit has settled, who’s included, and what steps you can take to receive your benefits. - You got the notice because the court is required to notify you

Rule 23 of the Federal Rules of Civil Procedure forces courts to contact everyone they can identify as a class member—and to use broader publication methods when they can’t. - Real notices follow a predictable structure

They outline the case, the class definition, deadlines, your options, and the process of filing a claim. Once confirmed real, you can file a claim, stay in, opt out, object, or opt in (in certain employment cases). - Scammers mimic real notices, so verify before acting

Search for the official settlement site, cross-check the case number, avoid suspicious links, never pay fees, and ignore requests for sensitive data. - The simplest way to never miss money is to rely on Settlemate

Instead of relying on junk mail and crowded inboxes, Settlemate scans for eligible settlements, matches them to your purchases, auto-fills claim forms, tracks deadlines and payouts, and notifies you when new opportunities open.

What is a class action settlement notice?

A class action settlement notice is a legal message telling you that a class action lawsuit has reached a settlement, and that you’re part of the group that may be owed money or benefits.

It’s one of the core notice types used in class action, and its purpose is to make sure you know a settlement exists and what to do next.

Sometimes, this notice is preceded by a class certification notice, which tells you the court officially approved the case as a class action.

Depending on the stage of the case, you might also receive:

- Notice of judgment – explains the court’s final decision and any compensation awarded

- Notice of hearing – alerts you to upcoming hearings related to the case

- Notice of attorney fees – breaks down the lawyer fees that will be taken from the settlement

- Notice of distribution – tells you when and how payments will be sent

Why did I get a class action settlement notice?

You got a class action settlement notice because the court believes the lawsuit in question may affect you.

Notifying you isn’t optional for the court. Under Rule 23 of the Federal Rules of Civil Procedure (and similar state rules), every identifiable class member must be notified of a proposed settlement. Judges require it so you have a fair chance to protect your rights, whether that means filing a claim, opting out, objecting, or simply doing nothing and staying in the class.

But how did you end up in that class in the first place?

People end up in class actions through normal life events: products they bought, services they used, or data breaches they never saw coming.

Here are the five most common ways.

1. You were part of a data breach

You might’ve had an account with a company that got hacked. Data breach class actions are some of the most common cases filed today. They usually include retail accounts, apps, financial services, and medical providers, where stolen health records can follow you for life.

Even if no one ever used your data, the exposure alone is enough to make you part of the class.

2. You bought a defective or mislabeled product

A product you purchased in the past may have been unsafe, faulty, falsely advertised, or recalled. Even if nothing went wrong for you personally, you can still be included in the class action.

3. You paid hidden fees or unfair charges

Banks, subscription services, utilities, and travel companies get sued regularly for improper billing. Your individual fee might’ve been small, but multiplied across millions of customers, it becomes a hidden fees class action.

4. You used a service that broke consumer protection laws

This could be anything from illegal data collection to misleading refund policies to subscriptions that were impossible to cancel.

5. You were part of a widespread incident or failure

You might’ve been affected by situations like outages, service disruptions, unsafe environments, or corporate practices, together with a large group of people at once.

What does a class action settlement notice look like?

The general appearance of a class action settlement notice is mandated by Rule 23. This rule is crystal clear: the notice has to concisely explain what the case is about, who’s included, what your rights are, and what happens if you do nothing. All of this has to be explained in plain, easily understood language.

Although there’s no single, court-mandated design for these notices, they generally follow the same pattern.

The table below outlines specific sections you might see in a class action settlement notice, and why each part matters.

Usually, class action settlement notices come in two forms:

- Full notice: The long form of the notice usually consists of several pages and walks you through every required element under Rule 23 in detail.

- Publication notice: The short form of the notice is a one-page, stripped-down summary designed for envelopes, postcards, or online ads. Its purpose is to alert you that you may be part of a settlement and tell you where to find the full version.

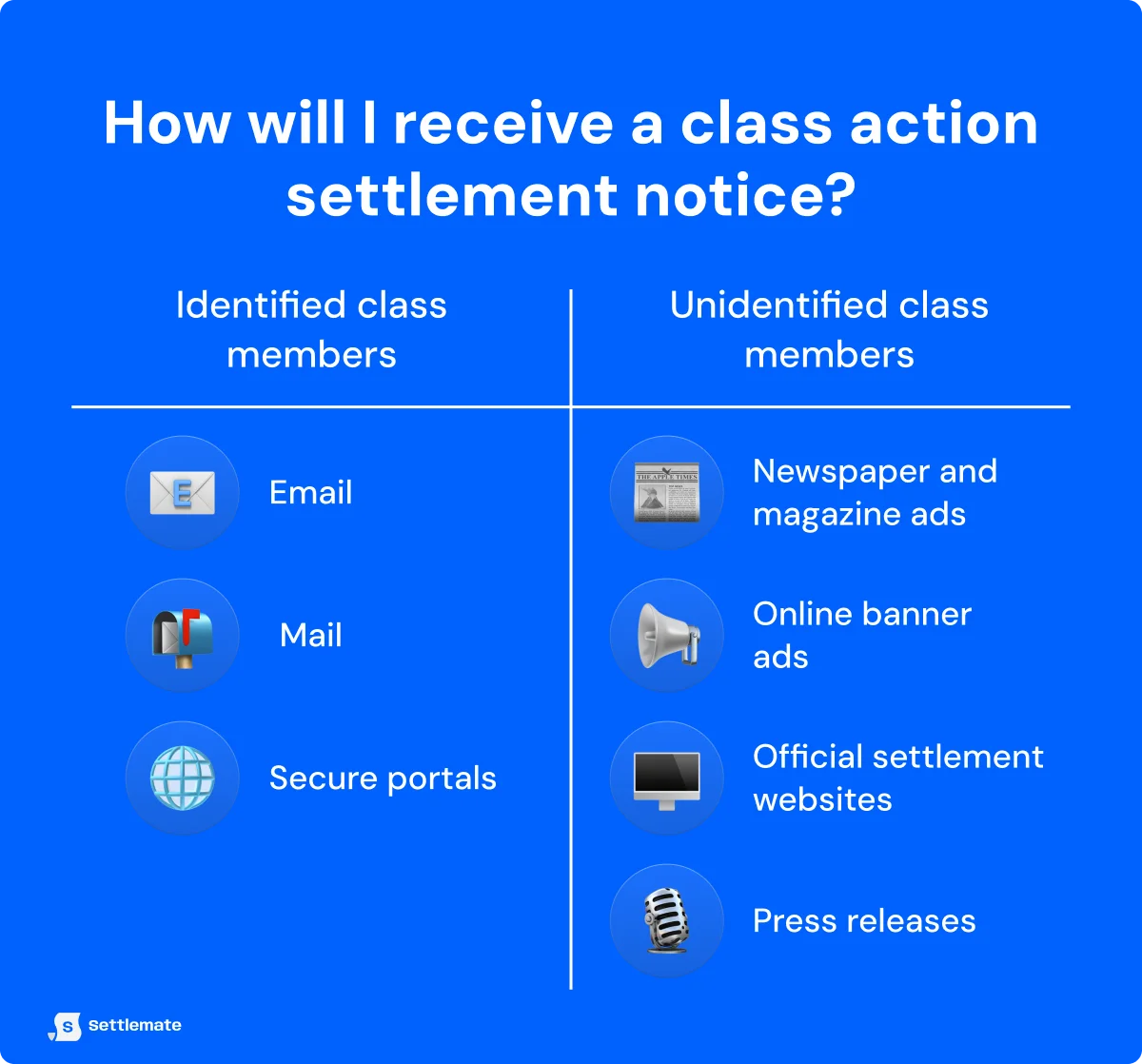

How will I receive a class action settlement notice?

If you’re reading this not because you received a settlement notice but because you just heard about a class action that might affect you, you’re probably wondering how you’ll get notified.

That depends on one thing: whether the court can identify you as a class member.

In most cases, the lawyers and a settlement administrator work together to figure out who the class members are and how to reach them. If your name and contact information can be found with reasonable effort, you’ll get a direct notice. If not, the court turns to publication methods.

Here’s how it works in practice.

If class members can be identified

Let’s say you subscribed to a service that was later found to charge illegal fees. In that scenario, the company already has a clean list of every subscriber, including you. During discovery, lawyers access those records to identify who belongs in the class.

Once the judge certifies or approves a settlement class, the administrator uses that data to send individualized notices through:

- Email (the most common today)

- Mail (letters or postcard-style notices)

- Both email and mail, if the court wants broader coverage

- Secure portals for certain regulated industries (e.g., healthcare)

These methods are used when the defendant’s records can reliably link real people to the issue through sources like:

- Customer lists

- Account histories

- Purchase records

- Medical files

- Membership databases

If class members can’t be identified

This time, you bought a mislabeled snack sold in thousands of grocery stores nationwide. The snack came from a shelf with no registration, no warranty card, and no account, meaning there’s no reliable list of the people who purchased it.

In cases like this, the court turns to a publication notice, through methods like:

- Newspaper ads

- Magazine ads

- Online banner ads or social media ads

- Notices on the official settlement website

- Press releases or public announcements

Lawyers propose a distribution plan for these notices based on where the product was sold or where the incident occurred. The judge then approves a strategy that gives the highest chance of reaching the affected group.

For example, if that mislabeled snack was primarily sold in California and Washington, the court might approve publication in outlets like the Los Angeles Times and The Seattle Times, along with targeted online ads seen by grocery shoppers in those regions.

How to spot a fake class action settlement notice

Class action settlements move serious money—more than $40 billion in 2024 alone. That kind of money should motivate people to file claims, get compensated, and hold companies accountable.

Instead, only about 4% of people who receive a settlement notice ever file a claim, according to an FTC analysis of major consumer settlements.

Why?

Because scammers know these cases involve huge payouts and confused consumers. So, they mimic real notices, build fake websites, and try to steal personal information.

During the massive Equifax class action—the largest consumer-facing settlement in U.S. history—scammers created imitation websites designed to look exactly like the real FTC-authorized claims site, forcing the government agency to intervene.

Here are the steps you can take to protect yourself and make sure you only respond to legitimate settlement notices:

- Start with the official settlement website: Instead of clicking on the link in the notice, search the case name + “settlement website.” A real site will show up immediately and include court documents, deadlines, and a clear case number.

- Cross-check the case number: Make sure the case number on your notice matches the one on the official website or in news reports. A mismatched number is a red flag.

- Avoid QR codes, shortened links, or odd URLs: Fake notices often use odd-looking domains or QR codes that lead to phishing sites.

- Check trusted aggregator sites: Sites like ClassAction.org or TopClassActions.com list active, vetted settlements. If the case doesn’t appear there, don’t move forward until you’ve confirmed the settlement is real.

- Use a trusted app: A legitimate claims tool like Settlemate can verify real settlements and auto-fill claims for cases you’re actually part of, without you needing to click anything risky.

- Look for real news coverage: Major settlements almost always hit reputable outlets. No coverage doesn’t automatically mean it’s fake, but coverage does help confirm legitimacy.

- Never pay anything: Legitimate claims are always free. Any “processing fee” or “filing fee” is a scam.

- Watch for inappropriate data requests: Real administrators may ask for your mailing address or email, but they will never ask for any sensitive information, such as your Social Security number, bank login, or full account numbers.

- Verify the claims administrator independently: Don’t call the number printed on the notice. Look up the law firm or administrator’s official website and contact them directly.

- Check whether deadlines and court hearings are listed: Fake notices often skip real dates or include vague “deadline coming soon” language. Legitimate notices are precise because courts require them to be.

What should I do after receiving a class action settlement notice?

Once you’ve confirmed the notice is real and reviewed the settlement details, you have a few decisions to make. The table below outlines your options:

Don’t wait for a notice, claim your money automatically

Understanding what a class action settlement notice is will likely lead to another, just as important question: how do you make sure you never miss a notice or the money that comes with it?

After all, class action notices are quite easy to miss or ignore, whether they arrive as a postcard buried in junk mail or an email that gets lost in your promotions folder.

That’s why you need a safety net: an app that finds the settlements you’re already owed before the notice ever hits your inbox.

Settlemate does this for you through tools like:

- Instant eligibility matching – Scans its entire settlement database and shows you exactly which cases you qualify for

- Automatic receipt and email scanning – Detects eligible purchases without any manual entry

- Lawyer-free, auto-filled claim filing – Submits your claim in a few taps with no paperwork and no attorney fees

- Real-time claim tracking – Shows status updates, deadlines, and payout progress instantly

- Smart notifications – Sends alerts the moment a new relevant settlement opens

Download Settlemate on the App Store or Google Play and start collecting your found money today.