“We regret to inform you that your personal information may have been compromised in a recent data breach.”

Not exactly the kind of message you want to see in your inbox. And yet, similar messages are showing up more than ever.

In 2024 alone, more than 1.35 billion breach notices went out—a 211% jump from the year before.

These figures are less surprising when you consider the U.S. leads the world in exposed data, with nearly 17.5 billion data points leaked between 2004 and 2024. To put that into perspective, Russia, the second-ranked country, trails far behind at roughly 4.5 billion.

So, where does that leave you?

It leaves you fighting back.

Because when a company fails to guard your data, you have the power to take action. Data breach lawsuits have surged 1,265% since 2018, proving that consumers are hitting back—and winning.

This guide walks you through every step of data breach litigation, from filing a claim to payout.

Key takeaways

- Confirm the breach before acting

Don’t assume an email means you’re affected. Verify the breach on the company’s official notice page or your state’s attorney general database. This ensures your claim is legitimate and based on verified information. - Collect solid evidence of harm

To build a strong case, gather every document that links the breach to your losses. This can include bank statements showing fraud, identity theft reports, and receipts for recovery expenses. The more proof you have, the stronger your case. - Know if you have legal standing

Courts only hear cases where the victim can show real harm, not just risk. You must demonstrate actual injury, a link to the company’s failure, and proof that the court can fix it. Without this, your case could be dismissed before it even starts. - Choose the right legal route for you

If your losses are large and specific, an individual lawsuit might yield higher compensation. For most people, joining a class action offers a faster, lower-cost path to accountability and fair payment without hiring a lawyer directly. - You don’t have to do it all yourself

Managing legal claims can be overwhelming, but tools like Settlemate make it simple. The app automatically finds the data breach claims you qualify for, fills out paperwork, tracks deadlines, and keeps you updated until payout, all while keeping your data secure.

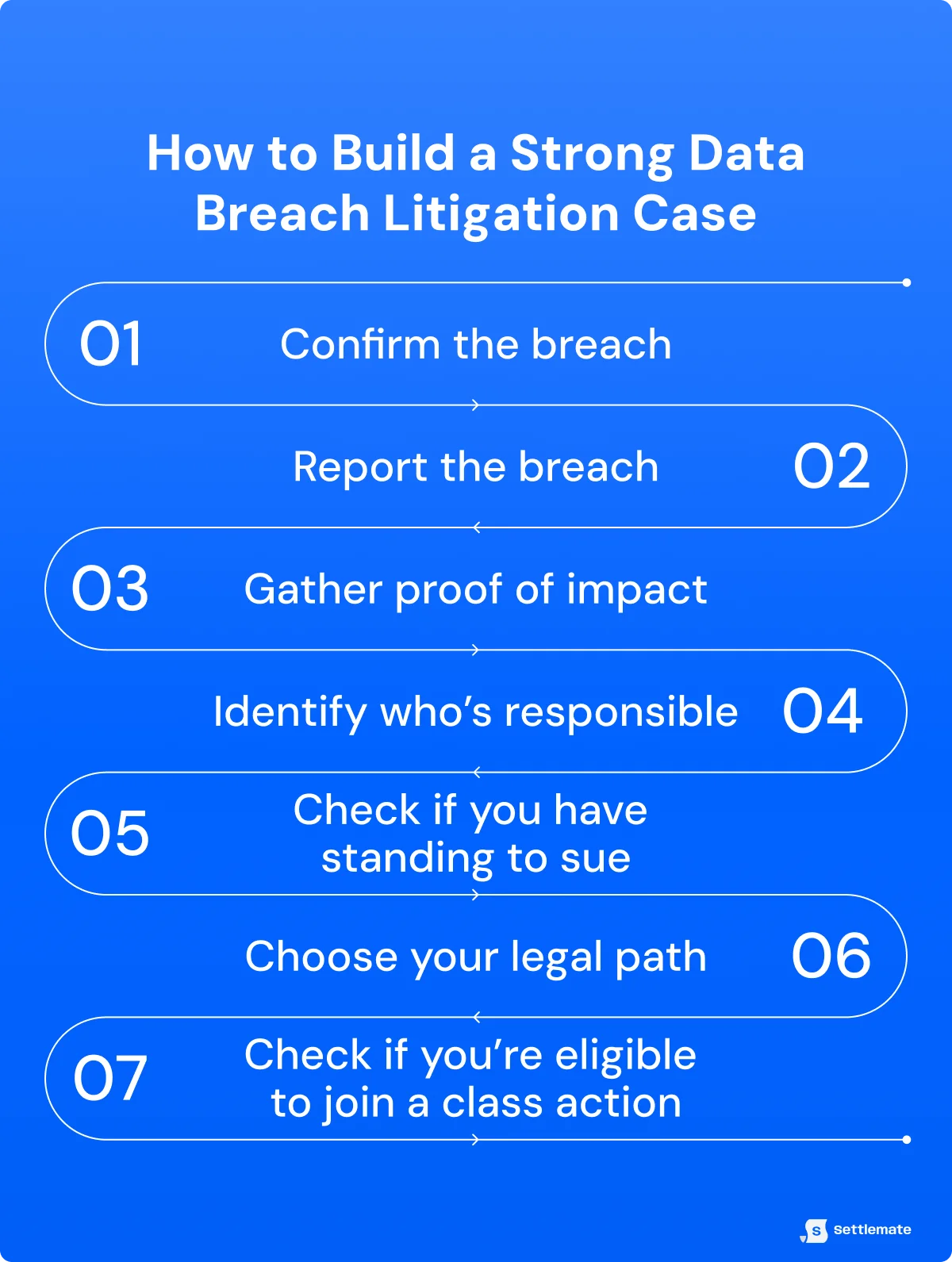

Before you file: 7 steps to build your data breach litigation case right

When a serious data breach hits, it’s natural to panic, but this won’t get you anywhere.

Changing your passwords, enabling two-factor authentication, freezing your credit, and watching your accounts closely is what actually protects you when you suspect you’ve been affected.

Once you’ve secured your data, it’s time to think legal.

But filing a claim isn’t Step 1—building your case is. Here’s how to do it right.

Step 1: Confirm the breach

Even if you’ve received the dreaded email informing you of a data breach, don’t just take it at face value. Confirm it.

Under U.S. law, companies are required to notify affected individuals and, in many cases, regulators, after a verified breach.

These notices must outline:

- What happened

- What type of data was exposed

- When the breach occurred

Most states now set strict timelines—often 30 to 60 days—to send those alerts.

Visit the company’s official breach notice page, or check your state attorney general’s breach database to confirm you were actually affected.

Step 2: Report the breach

If the data exposed in the breach could put you at risk of identity theft, you should file a report with the Federal Trade Commission (FTC) at IdentityTheft.gov.

This creates an official record and recovery plan.

While there, you can also check whether your incident appears in ongoing investigations listed on the FTC’s site.

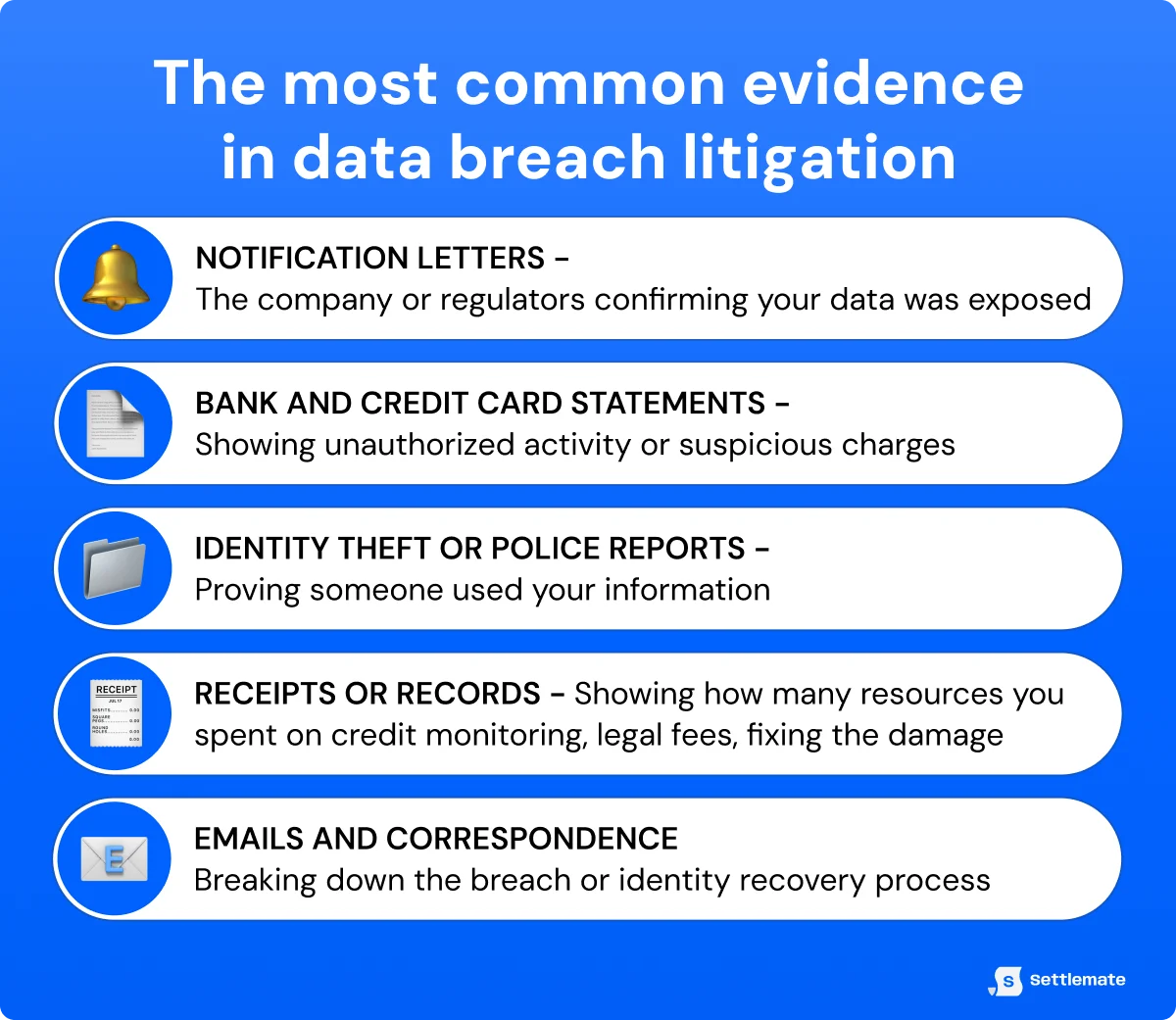

Step 3: Gather proof of impact

If you know for sure that you’ve been affected, it’s time to prove it.

Evidence is a huge part of any data breach litigation. You’ll need to show how the breach impacted your life financially, emotionally, or otherwise.

So, start collecting anything that connects the dots between the breach and your personal loss. This might include:

- Notification letters from the company or regulators confirming that your data was exposed

- Bank and credit card statements showing unauthorized activity or suspicious charges

- Identity theft or police reports proving someone used your information

- Receipts or records for credit monitoring, legal fees, or time spent fixing the damage

- Emails and correspondence related to the breach or identity recovery

Every document strengthens your standing to sue and builds the foundation for a successful data breach litigation.

Step 4: Identify who’s responsible

Figuring out who dropped the ball is a crucial step of the preparation process. It ensures your data breach litigation claim is targeting the right party.

In most cases, it’s the company that collected and failed to secure your data, but liability can spread wider.

Look at:

- The breached company for failing to protect customer information

- Third-party vendors or service providers, if the breach happened through their systems

- Hackers or malicious actors

It’s important to note that hackers are rarely the ones paying compensation, but they can still face penalties under laws like the Computer Fraud and Abuse Act.

Step 5: Check if you have standing to sue

This is the most important step in any data breach litigation because, without standing, your case won’t even make it into court.

In plain terms, “standing” means that the court agrees you’ve actually been harmed, not just worried your data might be misused in the future. To qualify, you generally need three things:

- An actual injury (e.g., fraudulent charges, emotional distress, or the cost of fixing identity theft)

- A clear link between the injury and the company’s failure to protect your data

- A fix the court can provide (usually financial compensation)

The table below breaks down the most common legal claims in data breach litigation and what you’ll need to prove them.

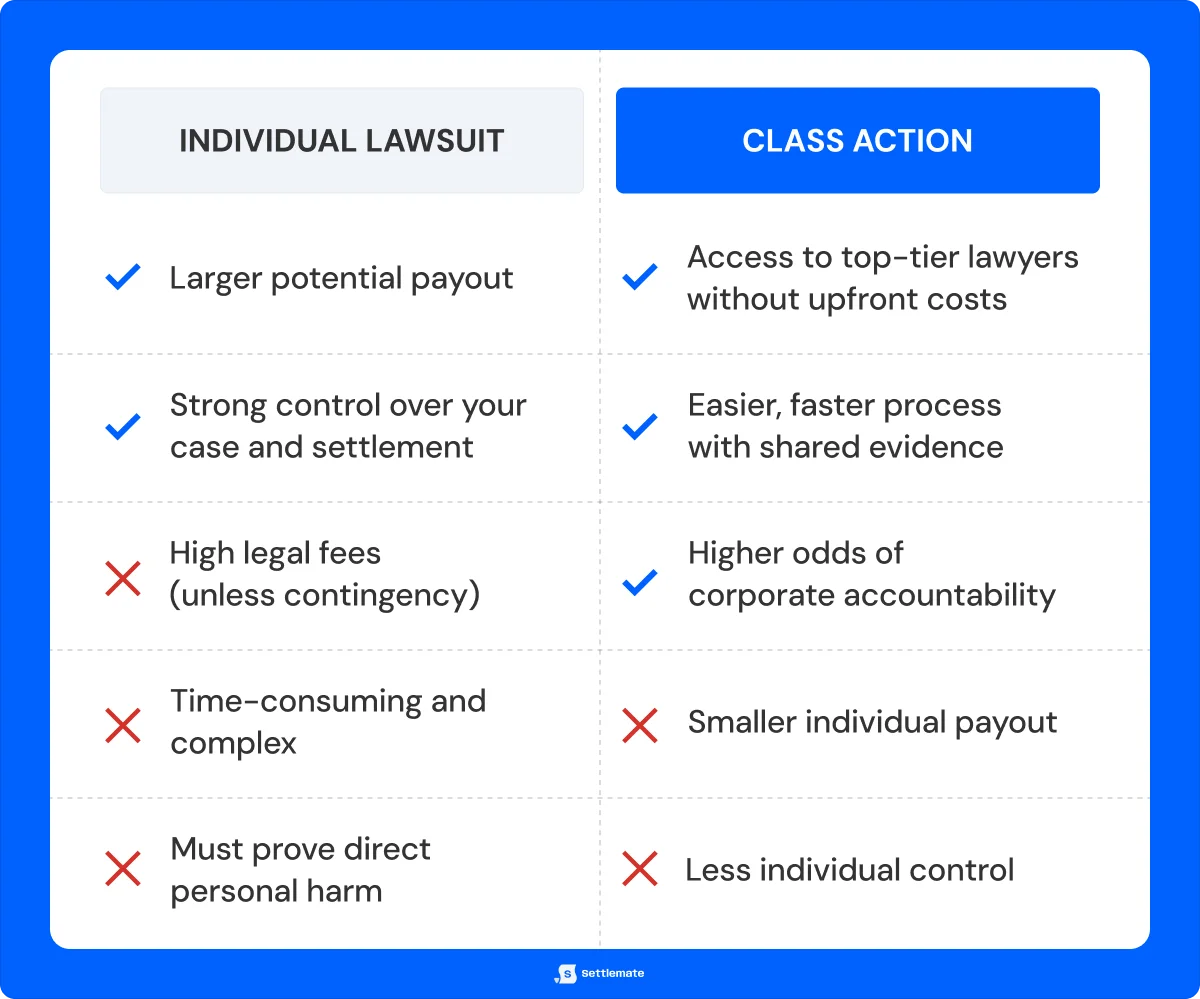

Step 6: Choose your legal path

After establishing your legal standing, you have two options: go solo or join the crowd. In legal terms, that means filing an individual lawsuit or joining a class action.

The solo route makes sense when your losses are substantial and well-documented. Think major financial fraud, ruined credit, or long-term identity theft.

Individual cases usually lead to larger payouts but are also complex, time-consuming, and expensive. You’ll need a lawyer experienced in high-value identity theft or privacy cases, and you’ll likely carry the costs upfront unless they work on contingency.

That’s why a class action lawsuit is the smarter play for most people.

Class actions combine thousands or even millions of similar claims into one powerful case, giving victims access to top-tier legal teams without making them pay out of their own pocket.

The trade-off?

Individual payouts are smaller. In some cases, like the T-Mobile data breach settlement, they were as small as $25.

Still, the odds of accountability are far higher in these lawsuits. Companies are forced to pay up, improve their security, and notify all affected users.

Step 7: Check if you’re eligible to join a class action

It’s not just a matter of choosing to join a class action—you must qualify for one. Class actions aren’t open to everyone automatically; they’re limited to people whose data and circumstances fit the certified class definition.

You’re generally eligible to join a class action if:

- Your personal data appears in the company’s confirmed breach records.

- You received an official notice identifying you as an affected individual.

- You experienced or are at clear risk of financial or identity-related harm.

- You’re a resident of a state covered by the lawsuit or meet its class definition (for example, U.S. consumers impacted between specific dates).

- You haven’t already settled or opted out of the case.

Filing your data breach litigation claim: Turning evidence into action in 3 steps

Filing your claim doesn’t have to be complicated. Just follow these three steps to move your case forward.

Step 1: Consult a lawyer (if needed)

How much lawyers get involved in your data breach litigation case depends on the size and complexity of your case.

If you choose to pursue an individual lawsuit, you’ll have to consult a data breach lawyer. These professionals will help evaluate your case, identify which laws apply, and design a strategy tailored to your circumstances.

As for a class action lawsuit, you might never speak to a lawyer directly, as the legal team representing the class will handle everything behind the scenes. Your role is simply to confirm eligibility and submit your claim when the settlement opens.

Step 2: File your claim

If you’re working with a lawyer on an individual lawsuit, they will draft and file the complaint for you. Your lawyer will outline the breach, the damages you suffered, and the relief you’re seeking, from reimbursement for losses to compensation for emotional distress.

If you’re part of a class action, you’ll typically receive or find a claim form online.

From there, you need to:

- Fill in your details

- Attach any proof of loss (if required)

- Submit it by the deadline

Once approved, your share of the settlement is processed automatically—no lawyer or court appearance needed.

Pro tip:

You can make this process even simpler by letting technology do the heavy lifting.

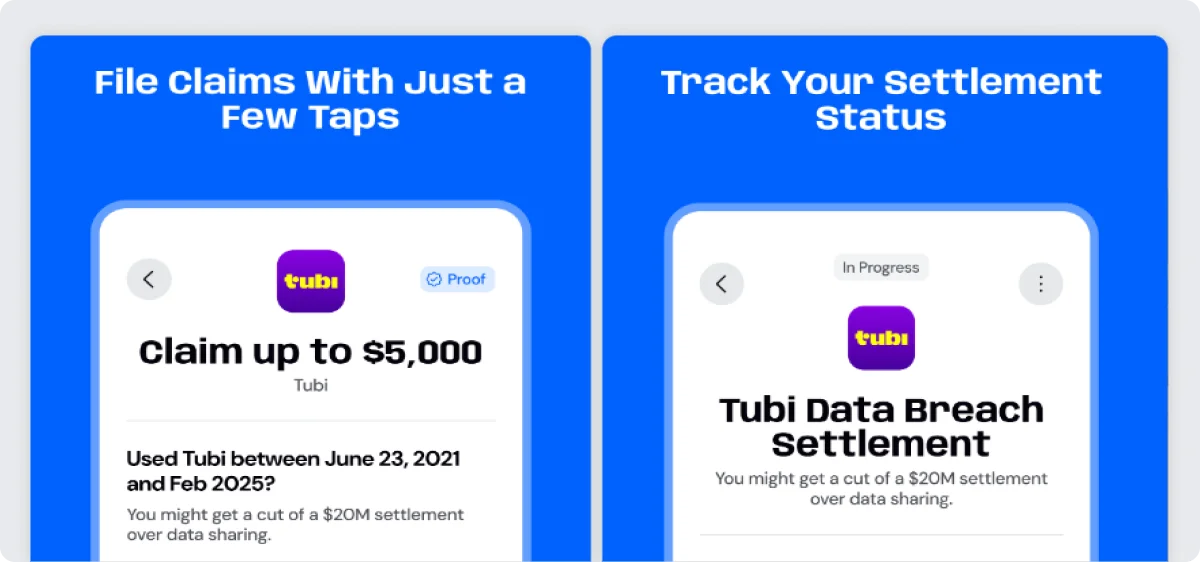

Settlemate automatically scans active settlements and class actions, checks your eligibility, and pre-fills claim forms, saving you the hassle of searching, verifying, and applying manually.

Step 3: Try to settle before trial

Settlement negotiations can happen at any stage of data breach litigation. In some individual cases, you might even attempt to settle before filing a claim in court.

However, most breach cases never reach trial. Companies usually prefer to negotiate and settle for three reasons:

- Trials are expensive: Defending a full-scale data breach lawsuit can cost millions in legal fees.

- Trials are risky: A jury verdict could lead to even higher damages and bad publicity.

- Settlements control the narrative: Companies can resolve the case quietly and show they’re taking responsibility.

After you file: What to do next in your data breach litigation

If settlement talks stall after filing the claim, your data breach litigation moves to a courtroom.

Now, this doesn’t mean a full-blown trial is guaranteed. Most cases move through a series of procedural phases before a judge or jury even hears the evidence.

Each stage gives both sides a chance to argue, negotiate, or narrow the case. Here’s how this typically plays out:

After winning the trial or securing your settlement, there’s only one step left: collecting your damages.

Depending on your case, compensation may include:

- Economic damages: You get money back for things like fraudulent charges, the cost of freezing your credit, or paying for identity protection.

- Non-economic damages: You’re compensated for the stress, frustration, or damage to your reputation caused by the breach.

- Punitive damages: In rare cases, the company may have to pay additional money as punishment for serious negligence—a warning to do better next time.

How to file a data breach litigation claim with Settlemate

The biggest individual and class action lawsuit payouts prove one thing: doing nothing gets you nothing.

Victims who act and file their claims consistently walk away with real compensation, stronger corporate accountability, and some peace of mind.

But here’s the thing: there’s also a way to do next to nothing and still get your share.

This is made possible by Settlemate, your shortcut from breach notice to payout.

Here’s how Settlemate makes filing a claim effortless:

- Automatic claim matching: Settlemate scans active lawsuits and settlements to show only the data breach claims you actually qualify for.

- Simplified filing: It pre-fills your claim forms and directs you straight to the official site. You’re still in control, but the process now takes minutes.

- Deadline tracking: Settlemate tracks every claim deadline, proof requirement, and payment update for you.

- Progress tracking: The app keeps you updated every step of the way so you always know where you’re standing.

It’s also worth noting that Settlemate ensures that your personal information stays encrypted and private. The app uses your data only to check eligibility and process your claims.

Ready to get started? Download Settlemate on App Store or Google Play and turn your data breach notice into a payout.