The estimated average personal injury settlement in the U.S. is $40,500—an amount that can make a meaningful difference for many households.

However, you don’t automatically keep all of it. Legal fees, medical liens, and other deductions come off the top. Even after that, the Internal Revenue Service (IRS) may want a cut of what’s left.

While the final amount you keep depends on several factors, the tax treatment of your settlement isn’t guesswork; federal rules clearly spell out what’s taxable and what isn’t.

So, this guide answers the core question: Are personal injury settlements taxable?

Key takeaways

- Most personal injury settlements aren’t taxable, but exceptions matter

Compensation tied to physical injuries or physical sickness is usually tax-free. Taxes come into play when money replaces something other than compensation for bodily harm. - What the settlement replaces determines the tax outcome

The IRS focuses on why the money was paid and how it was allocated. Labels alone do not control taxation—documentation and intent do. - Some settlement components are almost always taxable

Punitive damages and interest earned before or after judgment don’t qualify for the personal injury exclusion and are typically taxed, even when the rest of the settlement is not. - You can’t benefit from the same expense twice

Medical expenses reimbursed through a settlement become taxable if you previously deducted those expenses on your tax return. - You can’t get taxed on settlement money you never claimed

Many people miss out on class action settlements entirely due to missed notices, paperwork, or deadlines. Settlemate helps solve this by finding settlements you qualify for, handling claims, and tracking payouts so the money you’re owed doesn’t slip through the cracks.

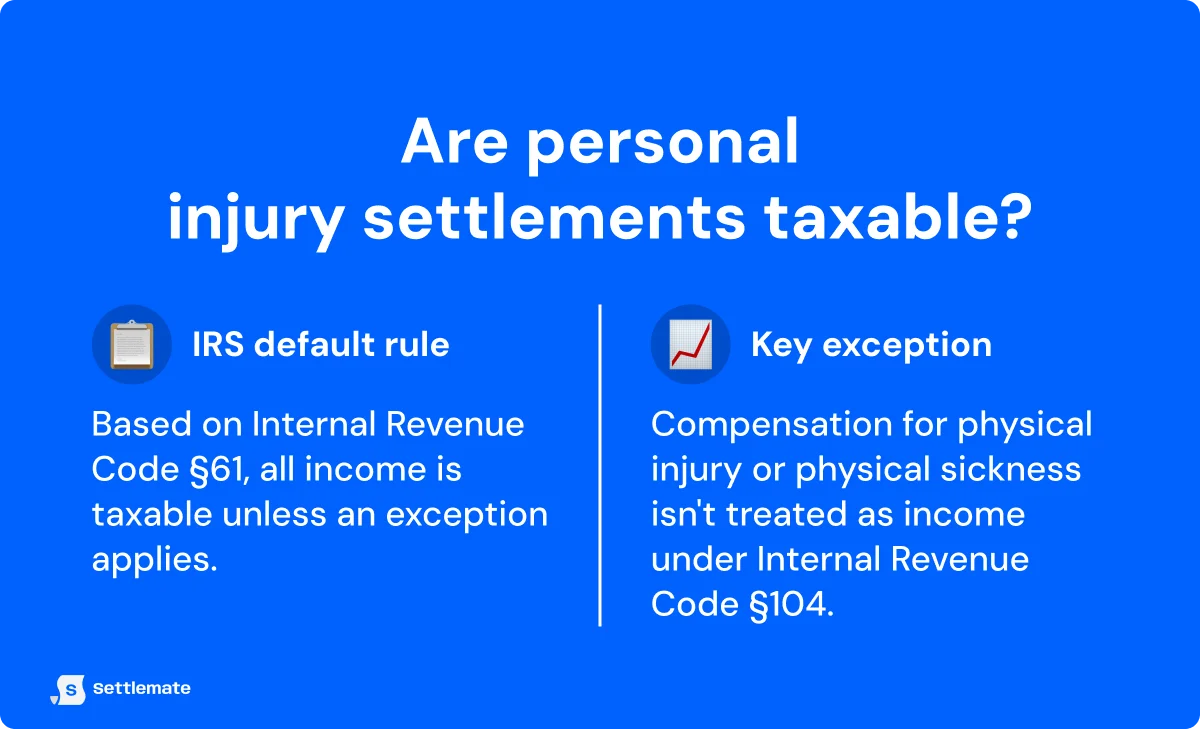

Are personal injury settlements taxable?

Many personal injury settlements aren’t taxable, but there are important exceptions.

Under Internal Revenue Code §61, the IRS considers all income taxable by default unless a specific exemption applies. Damages paid for personal physical injuries or physical sickness generally fall under that exemption in Internal Revenue Code §104, because the IRS views them as compensation for harm, not income.

That said, not every dollar in a personal injury settlement is automatically tax-free. Certain portions can be taxed, depending on what the money was intended to replace.

In practice, the IRS focuses on two core questions:

- Why was the money paid?

- How was the settlement allocated and documented?

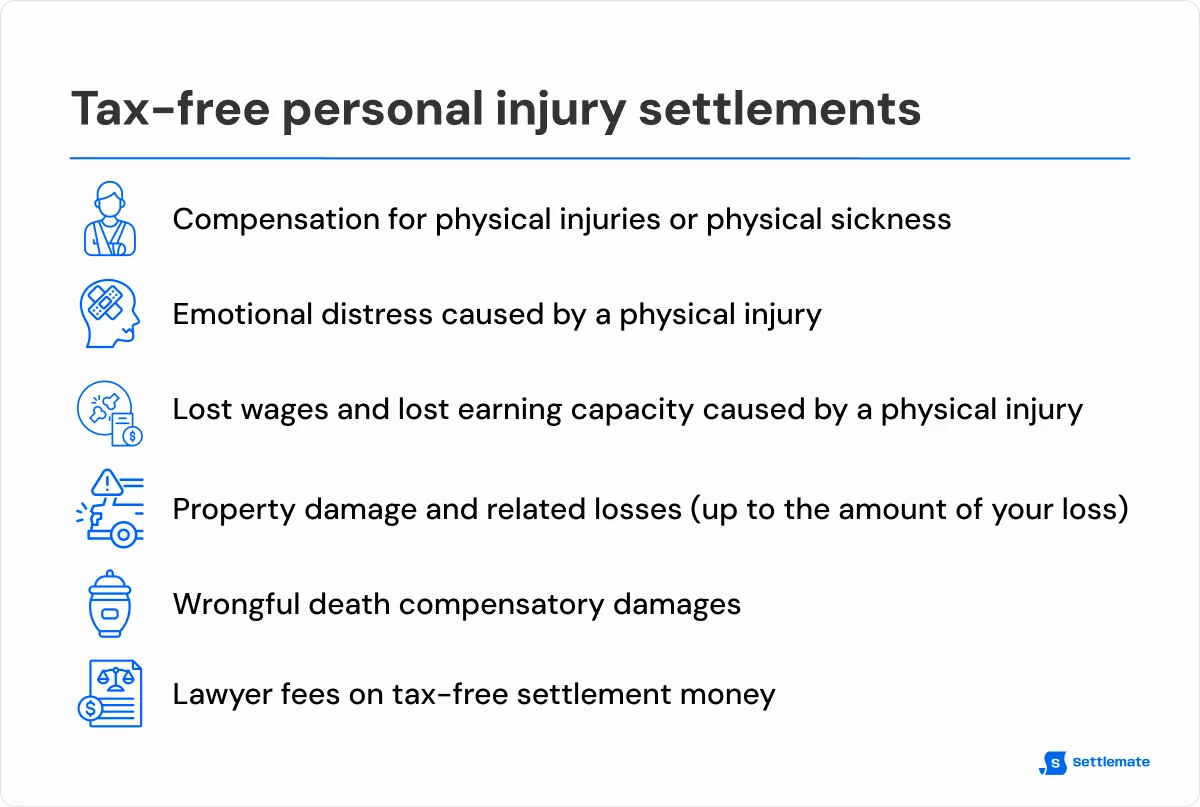

When are personal injury settlements tax-free? 6 key categories

If your settlement money falls into these six categories, you don’t report it on your tax return, and you don’t owe federal income tax on it.

1. Compensation for physical injuries or physical sickness

When your settlement is paid to compensate you for a physical injury or physical illness, the IRS generally doesn’t treat that money as income. The logic is simple: this is reimbursement for harm done to your body, not financial gain.

This category typically covers compensation for:

- Medical expenses (past and future), including hospital care, surgery, rehab, prescriptions, and medical devices

- Lost wages tied directly to the physical injury

- Pain and suffering caused by bodily harm

- Long-term or permanent physical impairment

Remember that the word “physical” matters here. If your claim doesn’t involve bodily injury or physical sickness, the tax treatment can change.

2. Emotional distress caused by a physical injury

Emotional distress is where people get confused and make tax mistakes.

Emotional distress can be life-altering regardless of its cause. Unfortunately, the IRS only focuses on that cause, and not the fallout.

So, emotional distress damages are tax-free only when they stem directly from a physical injury or physical sickness. That’s when the IRS sees emotional distress as a byproduct of bodily harm and treats it as part of the overall physical injury compensation.

This type of tax-free emotional distress compensation commonly includes:

- Anxiety, depression, or PTSD resulting from a serious accident

- Loss of enjoyment of life due to chronic pain or permanent injury

- Emotional trauma tied to visible scarring or physical disfigurement

- Mental anguish that flows from ongoing medical treatment or disability

3. Lost wages and lost earning capacity caused by a physical injury

Another area worth clarifying is lost income, because this is where many assume taxes automatically apply.

This makes sense, since wages are normally taxable. But when compensation for lost wages or reduced earning ability is paid as part of a personal injury settlement tied to a physical injury, the IRS generally treats that money as tax-free compensation.

Lost wages usually refer to income you couldn’t earn because a physical injury kept you from working. This can include:

- Time missed during initial recovery

- Ongoing absences for surgery, therapy, or follow-up medical care

- Reduced hours caused by physical limitations related to the injury

Lost earning capacity is different; it applies when a physical injury reduces your ability to earn income. This can cover situations where:

- You can’t return to your prior job due to lasting physical limitations.

- You’re forced into lower-paying work due to the injury.

- A permanent impairment limits how long or how much you can work in the future.

4. Property damage and related losses

In most cases, property damage compensation isn’t taxable.

That’s because it’s meant to restore what you lost, not enrich you. The IRS treats these payments as reimbursement, as long as you’re not being paid more than the property was worth.

Property compensation damages usually cover:

- Repair or replacement of damaged property, such as a vehicle, phone, or personal belongings damaged in an accident

- Temporary replacement costs, like a rental car or substitute equipment, while repairs are underway

- Out-of-pocket expenses tied to the loss, including towing, storage, shipping, or transportation costs

- Secondary costs caused by the damage, such as fees incurred because the property wasn’t usable

5. Wrongful death compensatory damages

Wrongful death compensatory damages are payments made to surviving family members to cover losses caused by a loved one’s death that resulted from another party’s negligence, recklessness, or intentional act. They’re meant to replace what the family lost financially and, to a limited extent, emotionally.

From a tax standpoint, these damages are generally not taxable. The IRS treats them the same way it treats other compensation tied to physical injury or physical sickness: as restitution, not income.

These tax-free damages commonly cover things like:

- Lost financial support, such as the income the deceased would’ve provided

- Loss of benefits, including health insurance or retirement contributions

- Funeral and burial expenses

- Loss of companionship, care, or guidance recognized under state law

6. Lawyer fees on tax-free settlement money

In contingency fee cases, the IRS generally considers that you’ve received the full settlement amount, including the portion paid to your lawyer.

That said, when the underlying settlement damages are excluded from income, the lawyer fees allocated to those damages typically remain excluded as well.

When personal injury settlements are taxable: 6 key categories

These six categories cover the most common situations where settlement money loses its tax-free status.

1. Medical expenses you previously deducted

While medical expense compensation in a personal injury settlement is tax-free in most cases, that changes if you have already claimed those same expenses as a tax deduction.

If you previously itemized medical expenses on your tax return and later receive settlement money that reimburses those costs, the IRS treats that reimbursed portion as taxable income. The reason is simple: you already received a tax benefit, and the IRS doesn’t allow the same expense to receive a second tax benefit.

When medical expenses are deducted over multiple tax years, the reimbursed portion is typically included in income on a pro rata basis, reflecting how the deductions were originally claimed.

2. Emotional distress not tied to a physical injury

When your distress doesn’t trace back to bodily harm, the compensation is generally treated as taxable income.

This most often applies to situations like:

- Anxiety or depression caused by workplace harassment without any physical injury

- Emotional distress stemming from wrongful termination or discrimination

- Stress, insomnia, or humiliation tied to defamation or reputational harm

- Psychological harm from a dispute or incident that caused no bodily injury

The only narrow exception is the reimbursement for actual medical expenses related to emotional distress. These may reduce the taxable amount, as long as those expenses weren’t previously deducted for a tax benefit.

3. Lost wages from non-physical claims

Lost wages become taxable when they’re paid as part of a claim that doesn’t involve a physical injury or physical sickness.

In these cases, the IRS treats the payment the same way it would treat a paycheck. That means it’s generally subject to income tax and, in some situations, to payroll taxes as well.

This most commonly applies to settlements arising from non-physical disputes, such as:

- Wrongful termination claims where lost pay is awarded for time out of work

- Employment discrimination cases compensating for missed wages or salary

- Retaliation or harassment claims that result in back pay or front pay

- Contract disputes where income was lost but no physical injury occurred

4. Property loss that exceeds your actual loss

Property damage compensation is tax-free only up to the value of what you lost. When a settlement pays more than that, the excess is treated as taxable income.

Here’s how property loss is typically valued:

5. Punitive damages

Punitive damages are almost always taxable, and this is one area where the IRS draws a hard line.

Unlike compensatory damages, punitive damages aren’t meant to reimburse you for a loss. They’re awarded to punish the defendant and deter similar behavior in the future.

Punitive damages may be awarded in cases involving egregious conduct, such as:

- A driver causing a crash while severely intoxicated, especially with prior DUI convictions

- A company knowingly selling a dangerous product and concealing the risk

- A defendant acting with intentional harm, fraud, or malice

- Conduct showing a willful or reckless disregard for public safety, far beyond ordinary negligence

The only possible exception is certain wrongful death cases where state law allows only punitive damages and no compensatory damages. In these cases, federal law may allow those damages to be excluded from income.

6. Interest earned on a settlement or judgment

Interest is always taxable, even when the underlying personal injury settlement is completely tax-free.

This happens because interest is payment for the time value of money, not compensation for an injury. The IRS treats settlement interest the same way it treats interest from a bank account or bond.

In personal injury lawsuits, interest can show up in two common ways:

- Pre-judgment interest – Interest that accrues while a case is pending, meant to compensate you for not having access to the money during the legal process

- Post-judgment interest – Interest that accrues after a judgment is entered but before the money is actually paid

Before taxes matter, you have to claim the settlement

Before you get to the question of whether personal injury settlements are taxable, you have to know the settlement exists and actually claim it.

In individual personal injury lawsuits, that part is straightforward. You have a lawyer, a case file, and a clear paper trail. Money doesn’t move without you knowing about it.

Class action settlements are different.

They often involve millions of people, quiet notices, short claim windows, and paperwork most people ignore or never see. Add in eligibility rules, documentation requirements, and eventual tax reporting, and it’s easy for legitimate settlement money to slip through the cracks.

That’s what Settlemate helps you avoid.

Settlemate is an app built to make claiming class action settlements easy by:

- Finding settlements you qualify for based on your purchases, accounts, and activity

- Handling claim forms for you, so you don’t have to dig through emails or receipts

- Flagging when proof is required and telling you exactly what to upload

- Tracking deadlines and payouts, so nothing expires or gets forgotten

Download Settlemate from the App Store or Google Play and start claiming settlement money that already has your name on it.